Help

Potsy Help

Welcome to the Potsy Help tutorials. We will be updating this help section over the next couple of months. If you have any questions or suggestions, please send us a message on our Instagram: @potsy.shop

Seller Quick Start Guide

So, you’ve just setup shop on POTSY! Congratulations!

This quick start guide will make sure you’re making the most out of your new shop ASAP.

Step 1: Verify your account

First things first, in order to sell on Potsy, you have to verify your account.

This is to ensure that only verified ceramic artists and ceramic companies are selling on our platform (to avoid mass produced wares and spam), and also because we have to submit your details to the Austrian Tax Authority to handle taxes (only once you have made more than 30 sales or sold more than €2,000 in the previous 12 months)

The following data must be collected for each shop before being allowed to sell:

- Full name or company name

- Address

- Birth date

- Tax number (TIN)

- UID number (VAT number)

- Company register number (if available)

- IBAN / bank account information or PayPal address

You can upload your documents here.

You can add your VAT Number and company details here.

If your Potsy shop has made more than 30 sales or sold more than €2,000 in the previous 12 months, then we will have to send your details the Austrian Tax Authority, plus the following details:

- Number of transactions per year

- Total sales per year

- Total Commissions that you paid to Potsy.

You will only be able to sell on Potsy once you have uploaded the required documents, and we have verified you.

Step 2: Profile Picture, Shop Header, Address & Bio

Next up, head on over to your shops settings and upload your profile photo and your shop header.

On the same Store Settings page, fill in your artist statement or shop biography, add your shop address, and also choose an address to be displayed on the map. For example, if you didn’t want to list your full address on the map, you could just choose London.

Next, you’ll want to link any social media platforms to your shop, e.g. so people visiting your shop can also follow you on Instagram.

Step 3: Your SEO

Head over to the Store SEO page and fill out your shops name and description, and also upload an image (usually the same as your shop header image).

This information is seen when your shop is seen in the search results of Google, or if your shop if shared on Facebook or Twitter.

Step 4: Your Shipping Destinations & Costs

Next, follow our Shipping Quick Start Guide and go to the Shipping Settings and choose where you want to ship your products to.

You cannot sell physical products before you set up your shipping.

Choose a shipping zone, and then add some shipping methods to it. We recommend starting with a flat-rate to get started, and then go for Table-Rate shipping to set up some flexible rules, for example, Weight based shipping costs.

Step 5: Adding Products

Now we have set up your shipping costs, you can go ahead and add some physical or virtual products, some bookable products, or some auction products to your shop.

All products are always added in USD.

You always add your products to POTSY using the United States Dollar USD as the price. POTSY displays USD, GBP, CAD, EUR, and AUD on the front end and customers can checkout in those currencies. Your customers bank will automatically convert from their currency for them.

To get the right price for your products, please check out www.XE.com for the current currency conversion rates before listing your products in USD.

Step 6: Promote your new shop

Once you’ve done all of this, it’s time to promote your POTSY shop! Post it to your social media, email it to your friends, add a link to it from your website.

Conclusion

That’s it! You’re ready to sell!

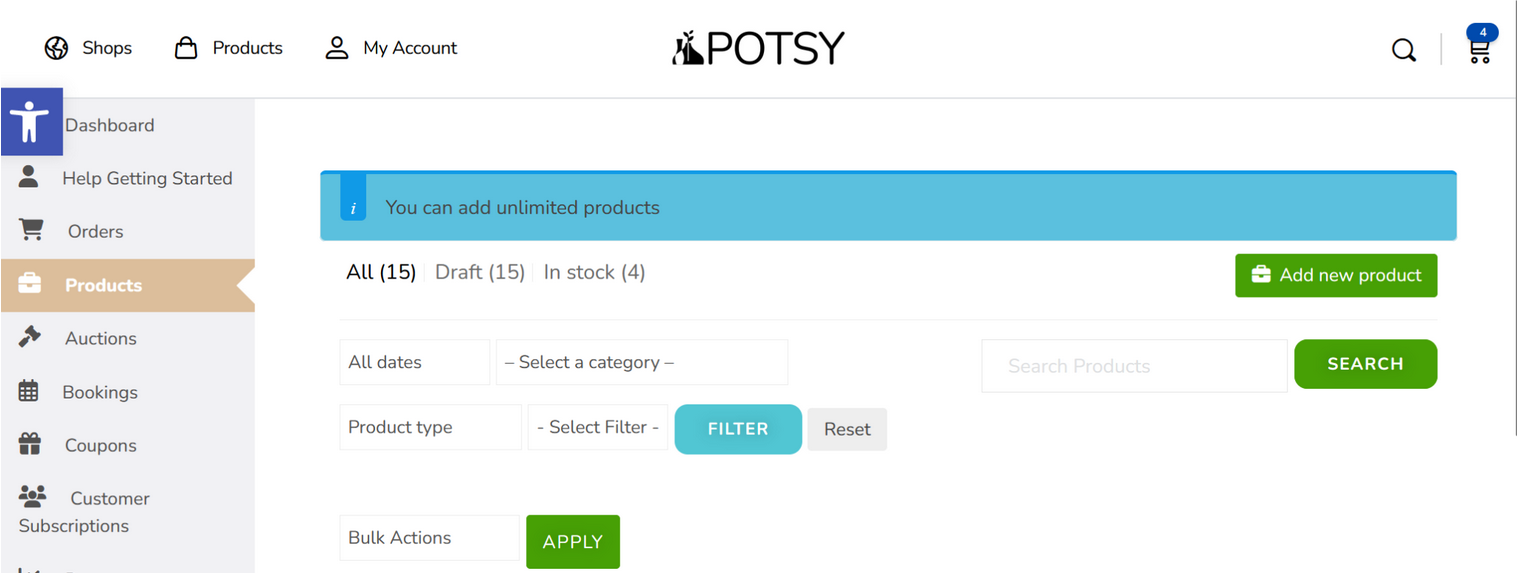

My Shop Dashboard

When you open a shop on POTSY, you can manage everything from the My Shop dashboard:

From the sidebar you can select different pages.

Dashboard:

The main view with graphs to show you quickly how your shop is performing.

Orders:

This is where you can view and edit your customer orders.

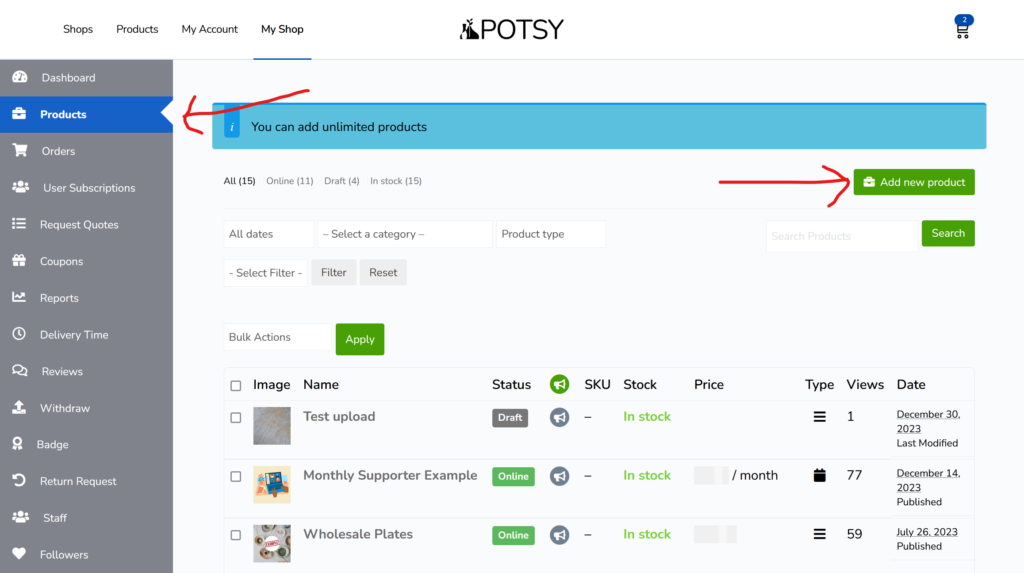

Products:

This is where you can add and manage your physical and digital products, including subscriptions.

Auctions:

This is where you can add and manage your auction products.

Bookings:

This is where you can add and manage your booking products, and also see your customers bookings and calendar.

Coupons:

This is where you can add and manage your shops coupons.

Customer Subscriptions:

This is where you can see your customer subscriptions for any subscription products you may have.

Reports

This is where you can see detailed reports about your shops performance.

Analytics:

This is where you can see how many visitors you have been getting to your shop, and which pages and products are performing the best.

Request Quotes:

This is where you can see any customer requests for quotes, for example, if you offer commissions, people can send requests for pricing here.

Return Requests:

This is where you can see any customer requests for returns.

Reviews:

This is where you can see your product reviews.

Followers:

This is where you can see your shop followers, who will all get email updates about your new products and coupons.

Note: Customers won’t get emails every time you upload a product or a coupon to your store; rather, they will get just one

email max per day. Inside the email it links to all the shops that they follow who have added new products or created new coupons in their store within the past 24 hours.

Badges:

This is where you can see your shops progress and awarded badges.

Staff:

This is where you can add and manage your shop staff, who can login and help you run your shop and perform actions based on the individual permissions you give them.

Support:

This is where you can see and reply to any customer support tickets.

Your Account Plan:

This is your POTSY subscription. At the moment we just have one FREE subscription for a POTSY shop, but we may add other subscriptions in the future.

Withdraw:

This is where you can see your current balance, and request a withdrawal to your PayPal account.

Announcements:

This is where you will find any POTSY announcements.

Seller Help

This is where you find the help tutorials for selling on POTSY.

Settings:

This is where you can change your POTSY shop settings.

Store Settings:

Manage your profile picture, shop header image, address, biography and other settings.

Shipping Settings:

This is where you can setup your shipping methods and decide where you want to ship to and how much shipping you should charge.

Payment Settings:

This is where you can set your PayPal address so that you can withdraw your funds.

Return & Warranty:

This is your returns and warranty section to specify if you offer warranty and returns and how much it costs.

Product Addons:

Manage global addons for your products, for example, if you want to add a gift wrap option to every product you list in your shop.

Store SEO:

This is where you can change the title, description and image of your POTSY shop when it is displayed in the search results of Google, or shared on Facebook or Twitter.

Linked Social Profiles:

This is where you can link your social profiles, e.g. your Instagram accounts to be displayed inside your POTSY shop header.

Account Verification:

This is where you can upload documents to verify your identity.

Setting up Shipping

You cannot sell your products without first setting up some shipping rules.

POTSY allows you to setup some simple or very flexible shipping rules. Although it may first appear complicated, it actually only takes a couple of minutes to setup your shipping rules.

Quick Start Guide:

Select Settings > Shipping to setup your shipping.

POTSY uses Shipping Zones and Shipping Methods to handle shipping to different continetns and countries.

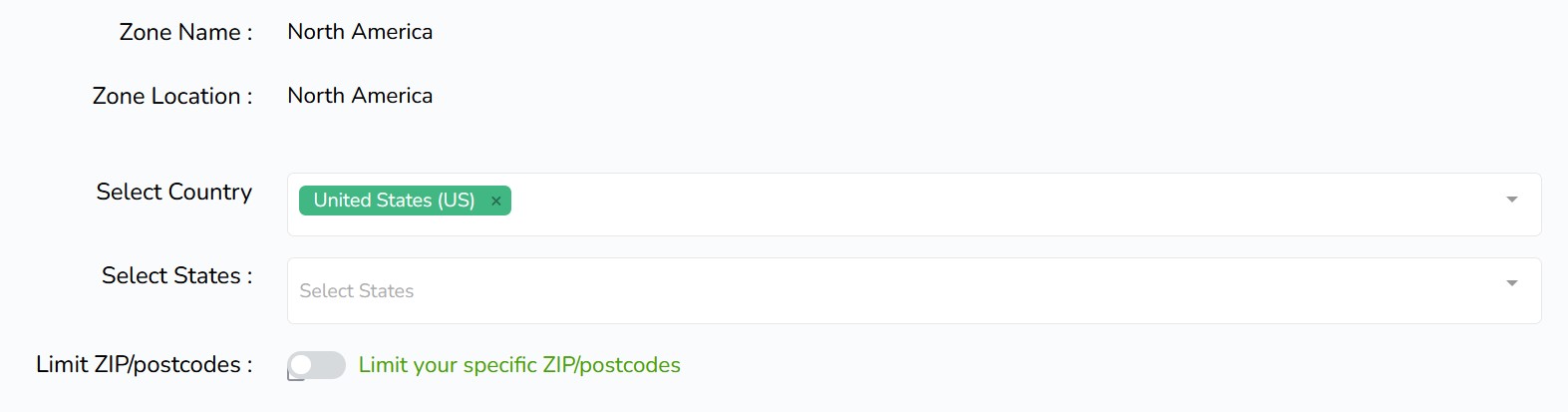

Say let’s say you want to just sell your products to the United States for example…

First, click the Edit button on the North America Zone.

Quick Start: Shipping Zones

Inside the Shipping Zone, you can keep all countries and Zip codes blank to allow shipping to all of the countries within North America, or you can select a country (e.g. the United States) from the drop down list of countries to only allow shipping to the US. You can then filter down to specific states, or even specific ZIP codes.

If you do not add a Shipping Method to a Shipping Zone, then customers inside the zone without shipping methods will not be able to order from you.

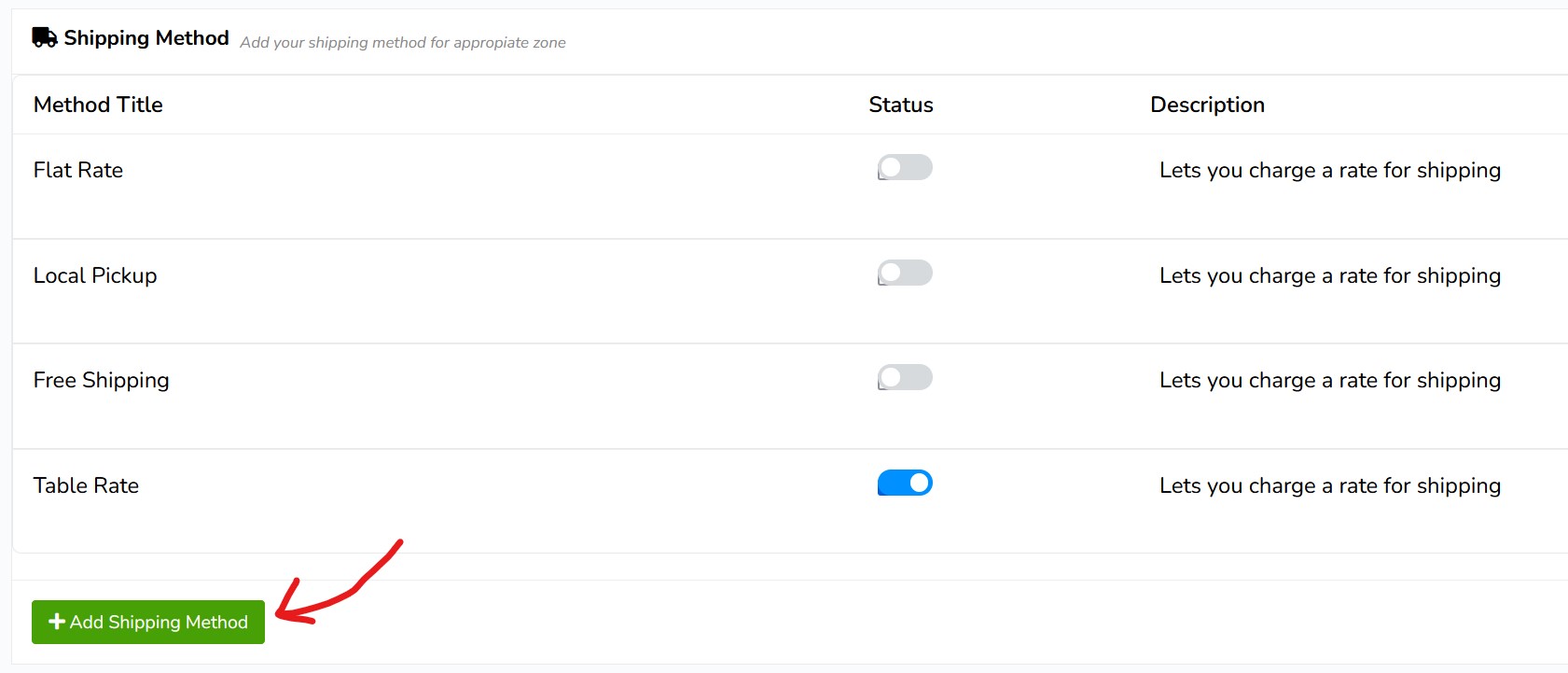

Next, add some Shipping Methods to the North America Shipping Zone.

Quick Start: Shipping Methods

Inside a Shipping Zone, you can choose different shipping methods.

This allows you to e.g. allow Free Shipping for the United States, and a Flat Fee to other continents.

So, for example, Add the Flat Rate shipping method to configure a single fee for each item in the order.

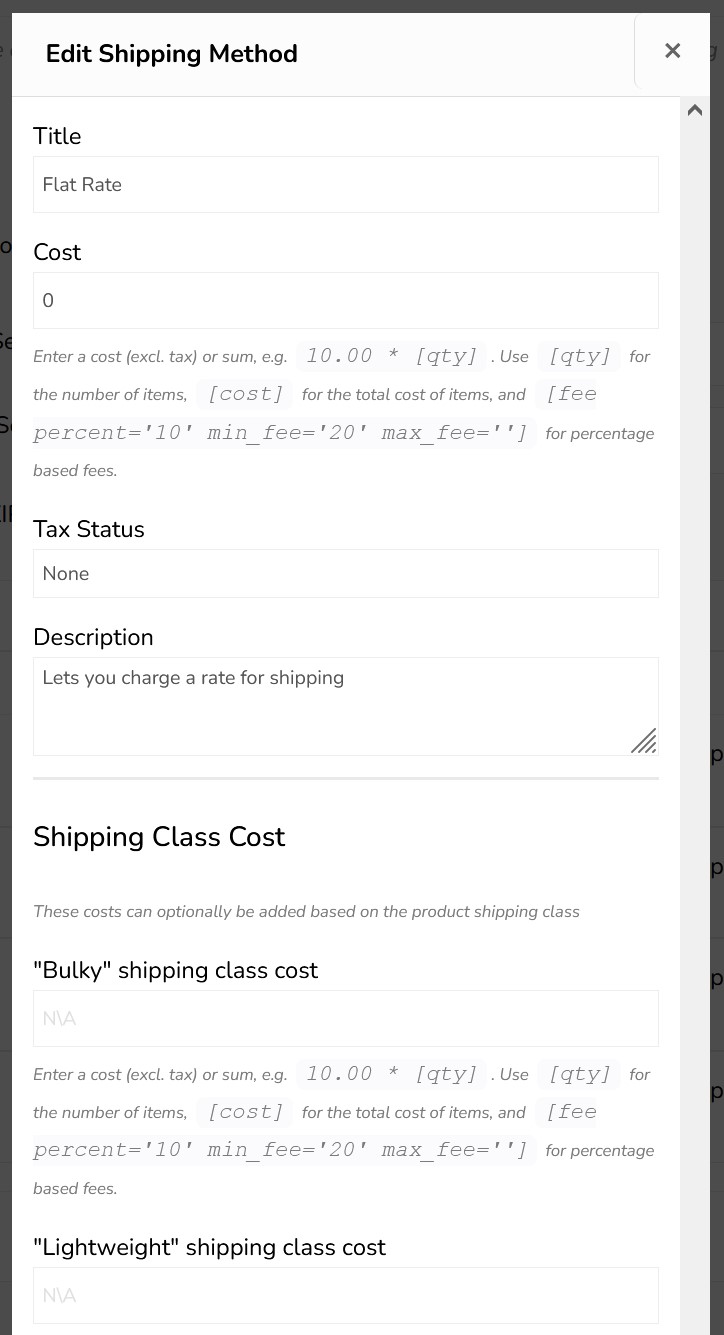

Inside the Shipping Method, we can select different options and prices depending on different Shipping Classes…

Quick Start: Shipping Classes

Each Shipping Method has a bunch of different Shipping Classes inside of it.

POTSY has setup several shipping classes – and when you add a product you can assign it a shipping class. This allows you to charge different rates of shipping for different items, for example, shipping a mug costs less than shipping a vase, or shipping a wholesale order of 100 plates.

We have the following shipping classes that you can assign to your products when adding products:

Normal Shipping

Give products this shipping class to charge a normal rate of shipping, for example, standard sized mugs etc.

Lightweight Shipping

Give your products this class when they are light, and require less shipping costs, for example, to ship ceramic jewellery.

Bulky Shipping

This shipping class allows you to charge more for bulky items, for example, vases, sculptures, etc.

Per Item Shipping

This shipping class allows you to setup shipping rates that are charged per item. E.g. $10 per mug in the order, so 2 x mugs would be $20 shipping.

Weight Based Shipping

If you assign this shipping class to your products, then you can setup weight based shiupping rules, for example, when selling lots of items you can total up the whole weight of the order and calculate the shipping that way.

Quick Start: Shipping Class Costs

Each Shipping Method can have different costs for each Shipping Class.

For example, if we add the Flat-Rate Shipping Method, we can change the cost for Normal Postage, Lightweight Postage, or Bulky Postage, etc.

This allows you to setup for example, a flat fee of $5 to send a pair of ceramic earrings that has the lightweight shipping class, a flat fee of $9.95 to send a mug which as the Normal shipping class, and a flat fee of $19.95 to ship out a vase which has the Bulky shipping class.

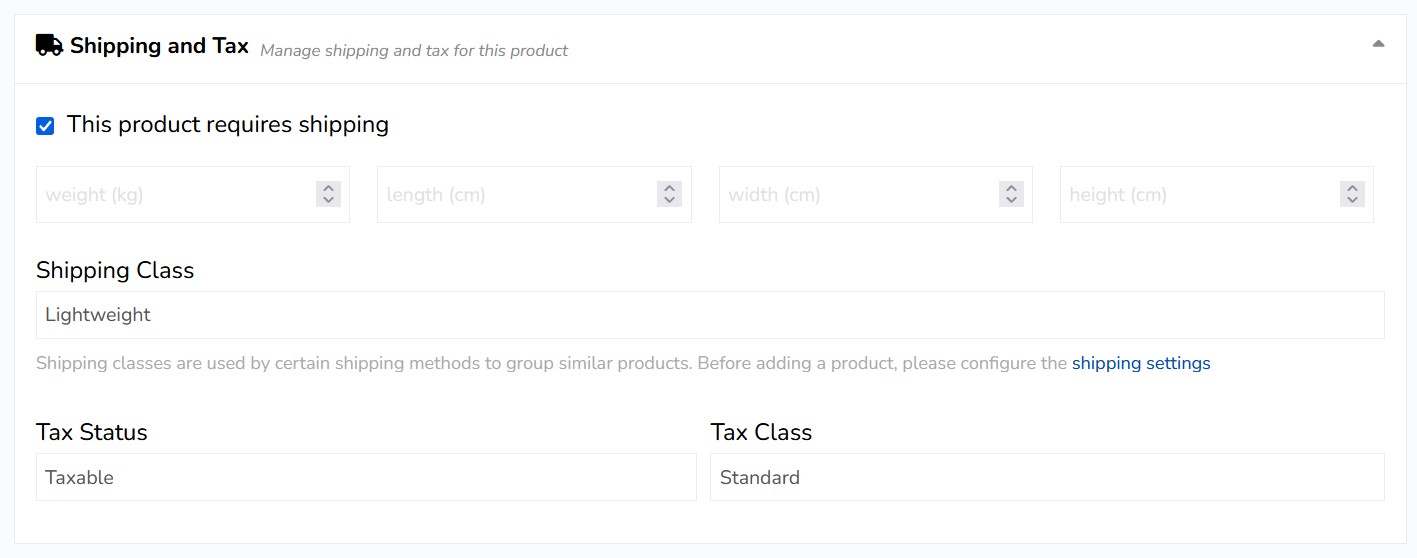

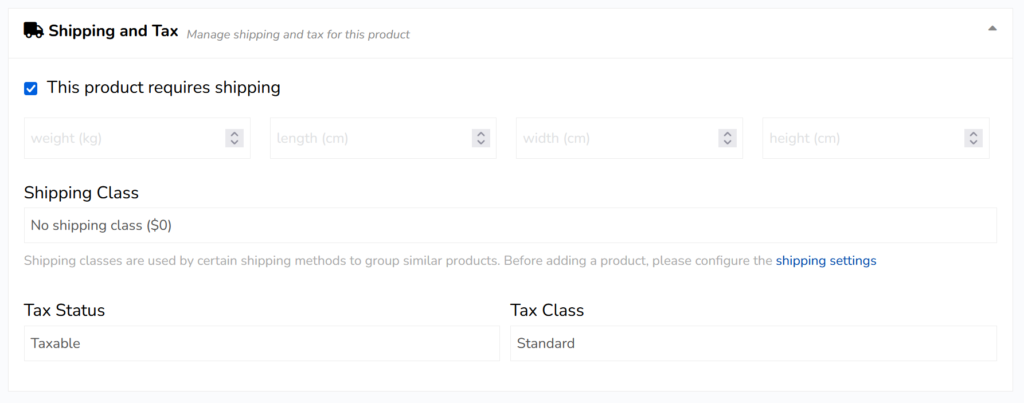

Quick Start: Assigning Shipping Classes to Products

Once you have setup your shipping zones, methods and class costs, you can start adding products, and it is then really easy to just select the shipping class for each product you upload.

When adding a Product, this is how it looks: You can select the weight of the item, the size, and the shipping class. For example, a pair of ceramic earrings may have the lightweight shipping class.

Quick Start: Add your Shipping Policies

When you write in your Shipping Policies, they will be displayed under each product you list, giving your customers confidence with the shipping process can help you make sales!

Processing Time: Choose to display how long it usually takes you to fulfill an order.

Shipping Policy: You can explain your shipping policy here, which companies do you use to ship, do you offer insurance etc.

Refund Policy: You can write here about your refund policy, if you offer refunds or not, and how they are handled.

This is the end of the Quick Start Guide.

This is the end of the quick start guide, continue reading for more details information and examples about shipping via POTSY.

Full Details of the Shipping Setup

Shipping Zones

POTSY has setup six shipping zones to account for the six continents.

Leave them blank if you do not ship to the continent. E.g. If I only ship to Europe, then I would add a shipping method to the Europe Zone and leave the other continents blank.

Hover over a shipping zone, and click on the edit button.

Shipping Countries

Within a Shipping Zone, you can also specify the countries, for example,

If you shipped to all countries in a shipping zone, then you can leave the countries field blank.

However, if you only shipped to Canada, you would select the North America Zone and then within it, choose Canada only.

You can also specify if you only ship to certain zip-codes / post-codes, or leave this field blank if you ship to all post codes. For example, if I shipped to the whole of England I would leave the postcodes field blank, but if I only wanted to ship to London, then I could enter SE1, SE2, SE3, SE4 etc as the post codes.

Shipping Methods

Add Shipping Methods to Shipping Zones

Select a method from the drop down list and then hover over it and select edit.

Flat Rate

Flat Rate: Enter a cost (excl. tax) or sum, e.g. 10.00 * [qty]. Use [qty] for the number of items, [cost] for the total cost of items, and [fee percent=’10’ min_fee=’20’ max_fee=”] for percentage based fees.

For example,

Entering 5 would mean that you would charge $5 shipping for the whole order, it doesn’t matter how many items the person has ordered.

10.00 * [qty] would be $10 for each item that someone buys from you. So if they purchased three mugs, then the shipping would be $30.

0.20 * [cost] would be $0.20 for each $1 of the order total. For example, a $100 vase would have a $20 shipping cost.

[fee percent=’5′ min_fee=’20’ max_fee=’100′] this would mean that the shipping fee would be 5% of the order total, with a minimum shipping fee of $20, and a maximum shipping fee of $100 per order.

Local Pickup:

Local pickup allows you to reward your local customers with free or cheaper shipping costs.

Free Shipping:

Free shipping allows you to offer free shipping to your customers in certain shipping zones or countries. Either all the time when you put the minimum order to 0, or if you add a price, e.g. 50 to allow free shipping for orders over $50.

Apply Minimum order rule before coupon discount:

For example, You have set $20 as the minimum order amount for free shipping eligibility, your customer has a product of $25 in the cart, and they also have a coupon that gives $10 off:

- If “Apply minimum order rule before coupon discount” is unchecked — The order amount is $25 – $10 = $15. The customer will not get free shipping according to the minimum order amount rule.

- If “Apply minimum order rule before coupon discount” is checked — The order amount is $25 and the $10 discount is ignored. The customer will get free shipping according to the minimum order amount rule. The coupon discount will still be applied.

Table Rate:

Table rate allows you to setup very flexible shipping rules for all of your items, so that you can charge the right shipping based upon item weight, units sold, etc.

Product Weight

The most common factor to consider is the product weight. Almost all shops consider product weight when it comes to shipping rates.

But what makes the table rate shipping different is the fact that not only the total product weight but you can even consider additional unit weight to calculate shipping.

Product Quantity

One of the major factors that most of the plugins ignore, is the quantity of the products in the cart. But thanks to table rate shipping, the store owners can make shipping rules based on the number of products in the cart. And just like weight, the option to calculate shipping for every single product added to the cart is also there.

Cart Value

There are instances when a shop owner likes to provide discounted shipping based on the cart value of the customers. Now, who doesn’t want to make his customers happy, right? Table rate shipping allows shipping calculation based on the total cart value as well as the additional per unit increase in the value of the cart.

As the name suggests, using table rate Table Rate Shipping, the vendors can have a set of rules based on the above factors, contained in a shipping table. Out of these shipping rules, the shipping cost is calculated based on the conditions set in the rule.

Creating a shipping table also proves to be useful in case of multiple shipping rules or a large shipping scenario. All the shipping rules organized properly in a tabular form is way better than having some pointers about each and every shipping rule available.

Shipping Calculations

Now since we are all aware of the factors on which table rate shipping calculates shipping, let us dig deeper into the way it calculates shipping cost.

While working with table rate shipping, one of the most important things to keep in mind is what happens when more than one rule is satisfied. It provides an option to select among Minimum or Maximum shipping rates in case of multiple shipping rules are satisfied.

- Method Title — Name of shipping method displayed to customers. For example, 1st Class and 2nd Class, if there are two methods for a zone.

- Tax Status — Define whether or not tax is applied to the shipping amount.

- Tax included in shipping costs — Define whether the shipping costs defined in the table are inclusive or exclusive of taxes.

- Handling Fee — Additional fee. Can be a fixed amount (e.g. $2.50) or leave blank for no handling fee.

- Maximum Shipping Cost — Can assign a maximum cost to a method. For example, if the total calculated is greater than the maximum cost, the price is decreased to maximum cost amount.

Calculation Type — Tells us how to calculate shipping on customer’s cart. Choices are:

- Per order – calculates shipping for the entire cart. If there are varying shipping classes in the customer’s cart, the class with the highest priority will be used (where 1 is the highest priority). These can be set in the table that appears underneath the rate table when per order is selected.

- Calculated rates per item – calculates the rate by checking each item in the customer’s basket against the table of rates.

- Calculated rates per line – looks at each line in the basket and checks that against the table. Multiple of the same item are on the same line, so the customer will only be charged once for multiples of the same item.

- Calculated rates per shipping class – each shipping class in your basket is totaled and offered at a final rate.

- Enter Handling fees per order/item/line/class.

Add a flat additional fee to the cost of each calculated item (this could be an individual item, line or shipping class based on the above settings). - Enter Minimum cost per order/item/line/class.

Set the minimum cost per calculated item (this could be an individual item, line or shipping class based on the above settings). - Enter Maximum cost per order/item/line/class.

Set the maximum cost per calculated item (this could be an individual item, line or shipping class based on the above settings).

Once you’ve chosen how to calculate rates, it’s time to start adding rates. POTSY will compare items in the customer’s cart against the table of rates to calculate shipping costs.

Shipping Class

Choose the shipping class to which this rate will apply. You can also choose to apply the rate to items in any shipping class or in no shipping class.

Condition

This column tells us what product information it should use to calculate rates. Your options are:

- None – you don’t wish to use product information to calculate the total

- Price – the price of the items

- Weight – the weight of the items

- Item Count – the number of an individual item

- Item Count (same class) – the number of items in the shipping class

Remember that the calculation is determined by the Calculation Type dropdown.

Min/Max

The minimum and maximum amounts for your chosen condition. These will be:

- Price – the minimum and maximum price

- Weight – the minimum and maximum weight. The weight is measured in Kilograms.

- Item Count – the minimum and maximum number of an individual item. For example, you may wish to have one price for 1-50 items and another for 50+ items

- Item Count (same class) – the minimum and maximum number of items in a specific class

If you are filling in minimum and maximum amounts for your item, ensure that you account for as many items as a person would conceivably order. For example, for item count, it’s good practice to have a row that has a maximum up to 999. This will ensure that shipping rates will always be calculated.

Break

When you check this option, you’re telling us: If you reach this row of the table, stop the calculation from going any further. Meaning, you’re telling the process to break.

This is used for:

- Per order – to tell us to offer a specific rate and no others

- Calculated – to stop any further rates being matched, with priority given to the top of the list. This is particularly important when merging shipping (see below).

Abort

Enable this option to disable all rates or the shipping you are editing if the row you are editing matches any item/class being quoted.

Shipping Prices

This is where you set the cost for your shipping. You can add the following figures:

- Row Cost – the base cost for shipping this item. This could include the cost of your packaging.

- Item Cost – the cost for each individual item. This is in addition to the cost.

- Cost per kg – the cost per kg for the items.

- % Cost – the percentage of the items’ total that should used to calculate shipping.

Label

If you are creating a per-order table of rates, you can add a label for each individual rate.

Class Priorities

If there are items in different shipping classes in the cart, the Table Rate will be calculated based on those items in the shipping class with the highest priority (or the lowest number).

Merging Shipping

There are times you may wish to merge shipping of a specific product. For example, imagine you have a pair of porcelain earrings and a mug. The porcelain earrings are in the lightweight shipping class, and the mug is in the normal shipping class. If a customer orders a mug and the porcelain earrings then you can simply bundle this shipping together. There’s no need to charge to customer for shipping the mug and the porcelain earrings separately.

If shipping for the porcelain earrings is usually $5 and shipping for the mug is $10, then you want to offer a shipping cost of $10, not $15.

To properly merge items for shipping, you need to ensure that the table is set up with the highest rate at the top and the lowest rate at the bottom.

What you need to do is to tell POTSY to: Go down this table of rates and stop when you get to the first condition that matches.

To merge rates in a simple setup, you would:

- Choose Calculated rate (per shipping class) for your calculation type.

- Create rates on the table, with the highest rate at the top. In our example of mugs and porcelain earrings, the normal shipping class is above the lightweight shipping class.

- Ensure that the Break option is checked.

Let’s take a look at the difference when the order and the break checkboxes are used.

In the first example, the table is set up correctly. Normal Postage is above Lightweight on the table, and the break checkbox tells us to stop the calculation when the first condition is met. The shipping price for the customer is $10. i.e., The porcelain earrings are correctly bundled with the mug.

In the second example, Normal Postage is correctly above Lightweight postage, but the break checkbox hasn’t been checked. This means that POTSY continues to calculate through the table for all of the items, calculating separately for each item and offering a final price of $15.

In this example, the break checkbox is checked, but Lightweight is above Normal Postage in the table. As POTSY calculates down through the table stopping at the first row in which its condition is met, it stops at Lightweight. The customer is offered the price of $5, which is the shipping cost for the porcelain earrings, not the mug.

In the final example, Lightweight is above Normal Postage in the table and the break checkbox is not checked. This time, POTSY checks every item in the basket against the table without stopping. It offers the price of $15 for shipping, totaling the cost for each line item, rather than combining.

Distance Rate:

Distance Rate retrieves the distance between your shipping origins and your customer and applies a rate per unit of distance (mile or kilometer) to calculate the shipping rate estimate.

This is useful if you want to deliver things yourself, e.g, in your car, or on your bike, and you want to charge based on how far or how long it will take you to drive or cycle there.

Enter the shipping address where you are shipping from:

Add your rules to the table like in the Table rate.

For example, here we have set it to be $1 per KM, and also $0.50c per hour needed to drive the order to the destination.

Examples:

Example 1: Shipping flat fee by weight

For example: Any items tagged with the Weight based shipping class, and that weigh up to 1 KG will be charged $4.95. Any items between 1KG and 5 KG will be charged $9.95, and any items above 5KG will get charged $14.95 shipping.

So if someone ordered two mugs which weight 500g each, then it would charge 2 x $4.95 = $9.90 as your shipping.

Example 2: Shipping calculated by weight

If we sold plates, they weighed 250 grams each (0.25 KG) and in the product settings we included the weight and set the shipping class to Weight Based shipping:

Then, if you wanted to charge $10 per kilogram shipped, and set up the table rate so:

Then if a customer wanted to buy 5 plates, then it would charge $2.50 per plate = $12.50 shipping.

Adding Products to POTSY

1. Click on the Products menu.

2. Click on the Add New Product button on the top right of the page.

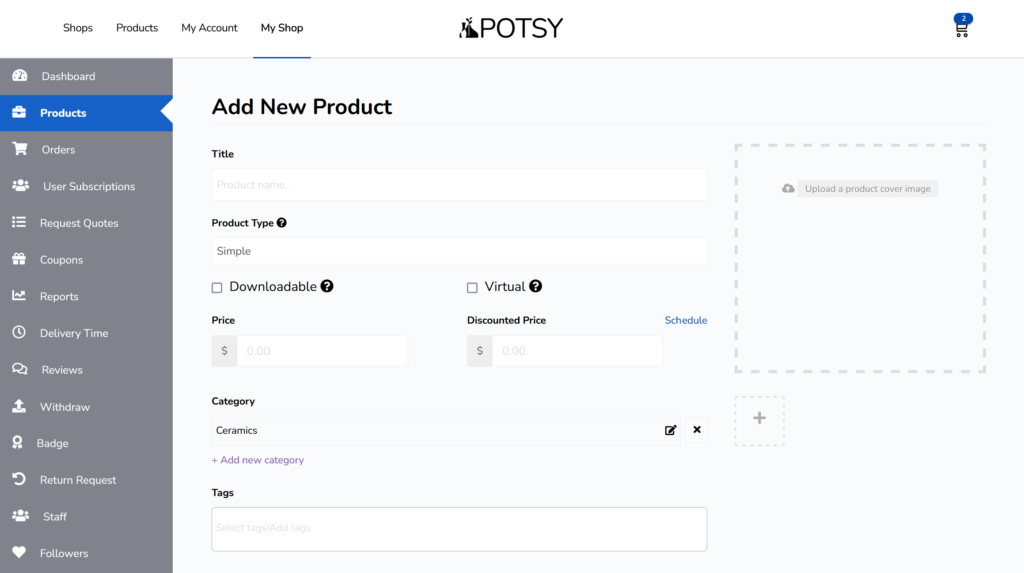

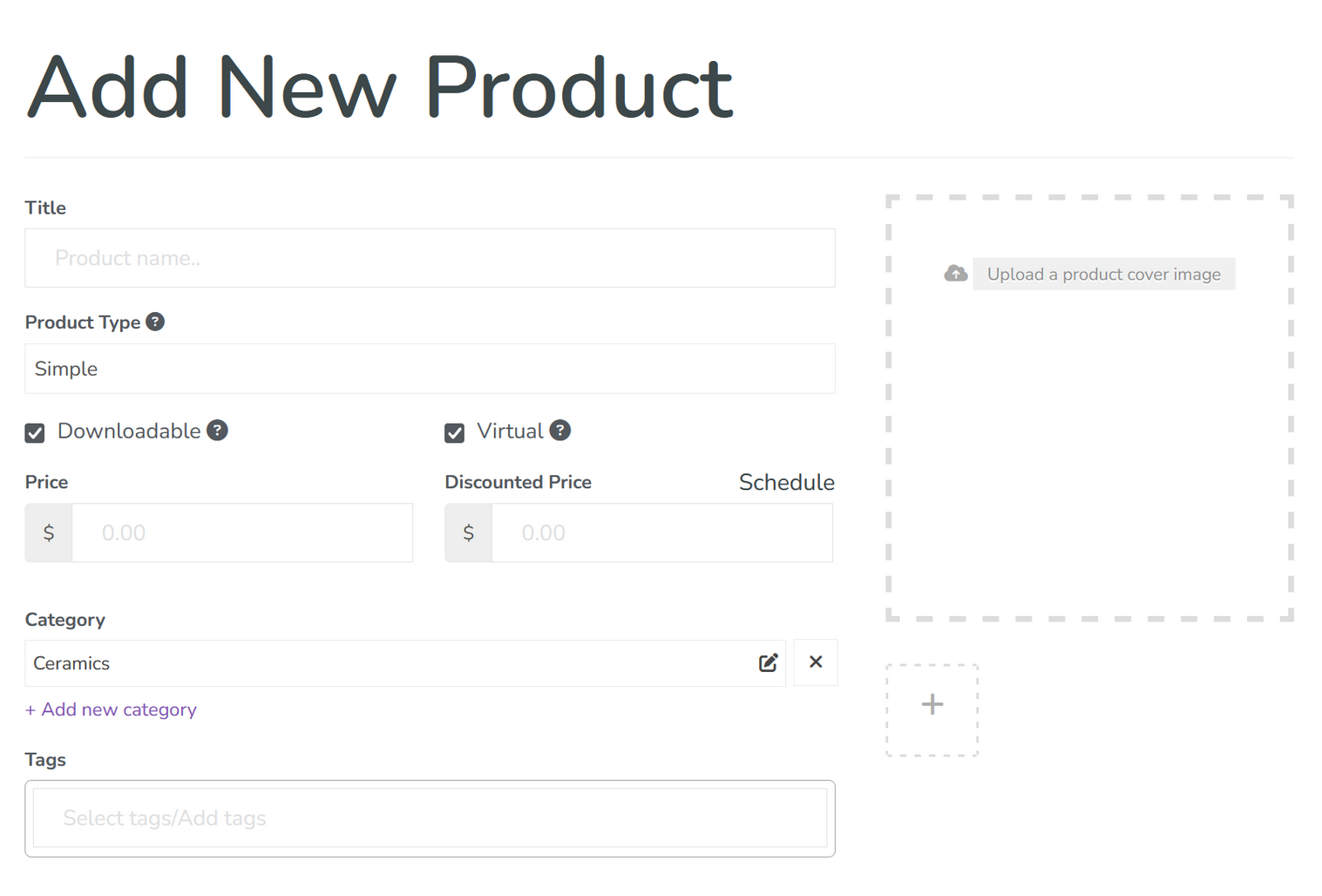

3. This brings up the Add New Product screen:

From here, you can add all the details of the product.

The Product Title

Here you can give your product a name, for example “Large Blue Coffee Mug #123”

Product Type

Here you can choose what type of product you will be selling is:

Simple product

This is the type of product you would select if you want to sell your ceramics simply listing them one by one. E.g. you made 10 different bowls, you could list them all individually as simple products.

Variable Product

This allows you to setup variations of the product, which is most common for example when selling a T-Shirt design you can choose different sizes and colors of T-shirts.

Here, you can e.g. sell a certain style of mug, and set up two attributes for the product: size and glaze color. This would let the customer decide the size of your mug, and the glaze combo they want.

Grouped Product

Let’s say you sell tea sets, and you list Tea pots, Tea Cups, Creamers, and Saucers in your shop, all as individual products.

One of your customers would have to go through your shop and add the items individually to their basket.

Well, a grouped product allows you to add separate products into one product page.

So for example, you could make a group product called “Tea Set” and then add into it the different products of “Tea Pot”, “Tea Cup”, “Creamer” and “Saucer”.

Now, instead of a customer having to go through 4 different product pages to add everything to their cart, they can choose everything from one product page, and the customer can decide how many of the tea pots they would like, how many tea cups and how many saucers.

Simple Subscription

This allows you to chaarge a set price on a schedule, for example you could be selling a “Mug of the Month Club” product, where for $50 / month you send out a mug to your customers.

Or, you could be selling a monthly membership to come to your pottery studio, etc.

You can choose the price, and the schedule, e.g. daily, weekly, monthly, or yearly.

Variable Subscription

Let’s say you have a studio space and you sell two types of memberships, one that allows customers to come for 10 hours per week, and another that allows them to come for 20 hours per week.

You could set this up as two separate simple subscription products, or you can set it up as a single variable subscription – so they only have to go to one product page to make the choice.

For a variable Subscription product, from the product page, the customer sees a drop down box with the choices of subscriptions.

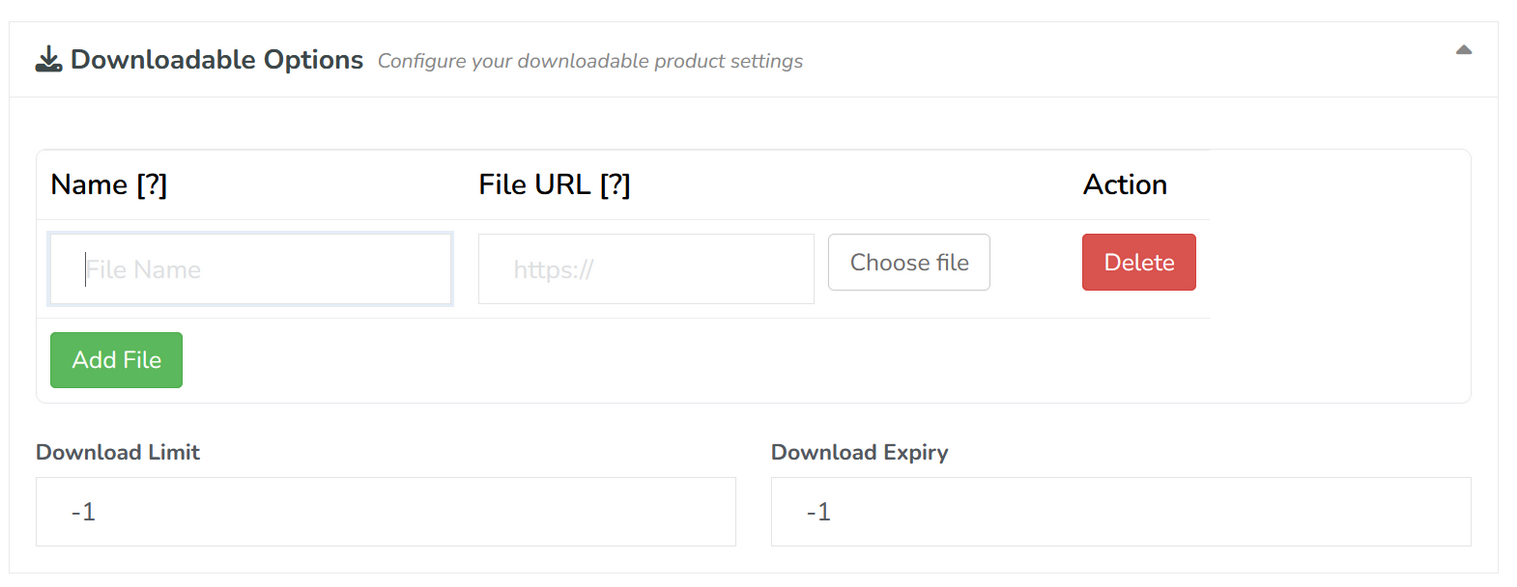

Downloadable Products

This is handy when you want to include a digital download to the order. When selecting the Downloadable checkbox, a new field will appear which will allow you to include a link for customers to click on.

This can be e.g. a PDF lesson plan, a link to a private YouTube video lesson, a link to a Google Drive folder full of goodies, or anything else virtual.

Once the customer buys your product, they will see the links in their order page.

Virtual Products

Virtual products are those which do not require shipping, for example, links to hidden YouTube lessons, Hand building template PDFs, etc.

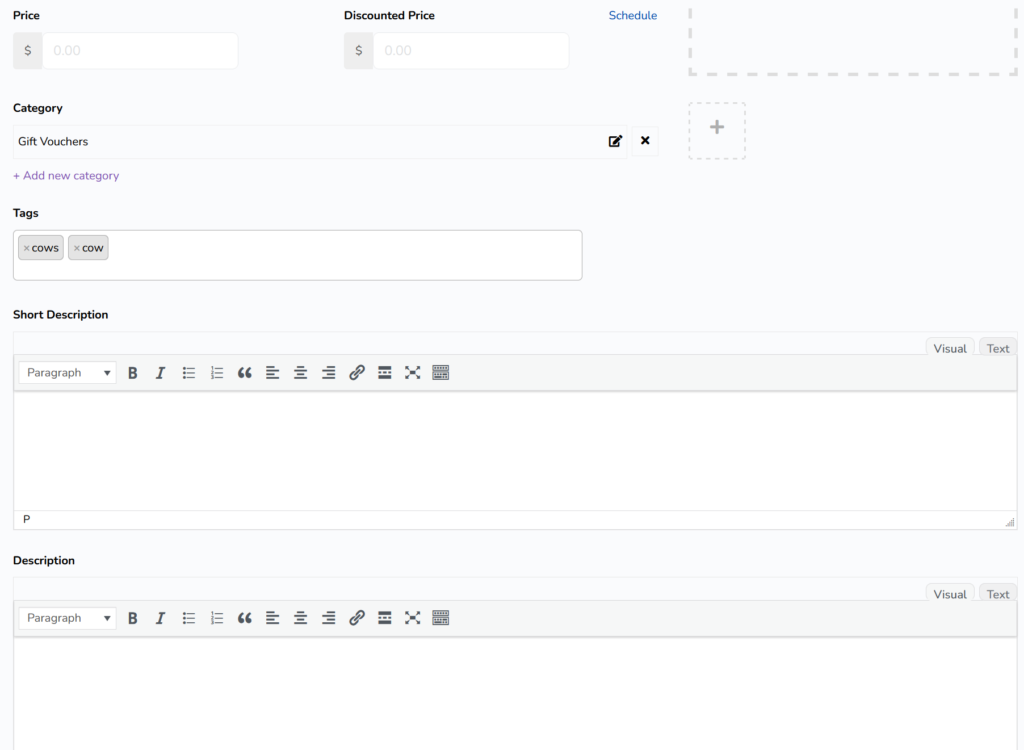

Basic Options

Price

Enter the full price of your product.

Discounted Price

Leave this blank if you do not have a sale on.

If you have a sale on, then enter the discounted price here. The discounted price must be less than the original price.

Category

Select where your product shows inside our categories.

Tags

Here you can add any other tags to your product, for example, if you sell a vase with a cow-print pattern on it, you may want to add the tag “cows” so that people searching POTSY for cows will find your product.

Short Description

This is the short text which appears directly below your product title, next to your product image and above the checkout button.

You should keep this short and sweet, we would suggest one sentence only, so that the Buy button is still visible at the top of the page.

Description

This is where you can add more information about your product. The description can be any length.

Product Cover Image

This is the main image of your product which will be seen right away by people browsing POTSY or coming to your product page.

Gallery Images

Below the Product Cover image you can add up to 4 more images, which will be seen when someone lands on your product page.

This is good for showing extra views of your ceramics.

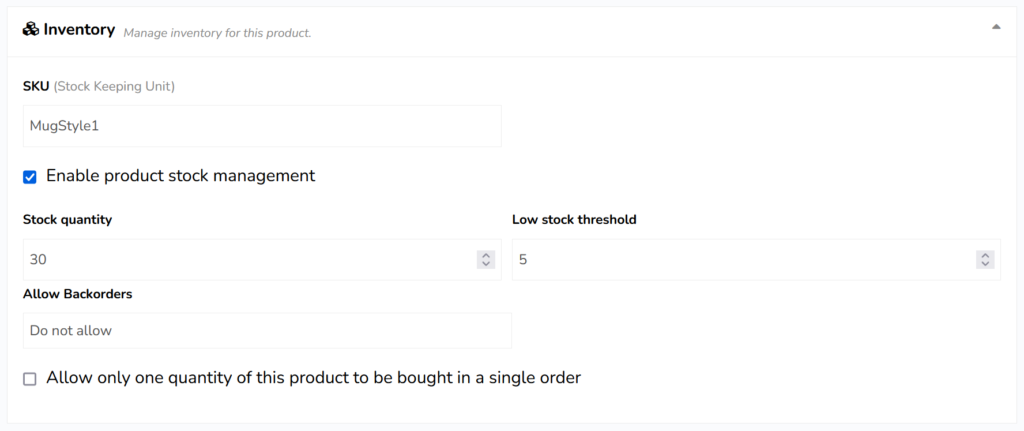

Inventory

SKU

The Stock Keeping Unit is the internal number you give your products, for example if you are selling a batch of 100 mugs, you may want to number them Mug1, Mug2, Mug3… up to Mug100.

This helps you make sure that you are shipping out the correct item.

Stock Status

In Stock

The product is in stock and is available to purchase.

Out of Stock

The product is not in stock and is not available to purchase.

On Backorder

The product is not in stock, but is available to purchase, for delivery when the product comes back in stock.

Enable Stock Management

This allows you to select how many of the products you have, and what happens when they sell out.

E.g. you have 30 mugs of all the same style. You set the enable stock management and type in that you have 30 available, and the low-stock threshold of 5.

Once you sell 25 mugs, then a notice will display on the product page to say that they are “low in stock”.

Once they all sell out, the product will no longer be able to be purchased – depending on what you choose for the Allow Backorders box.

Only one quantity per order

Choose this if you only want one item to be bought per customer. For example, if you have a set of 30 mugs, but want them all to go to different people.

Or, if you are selling a monthly subscription and want to make sure that you can only checkout with one and not double charge your customers.

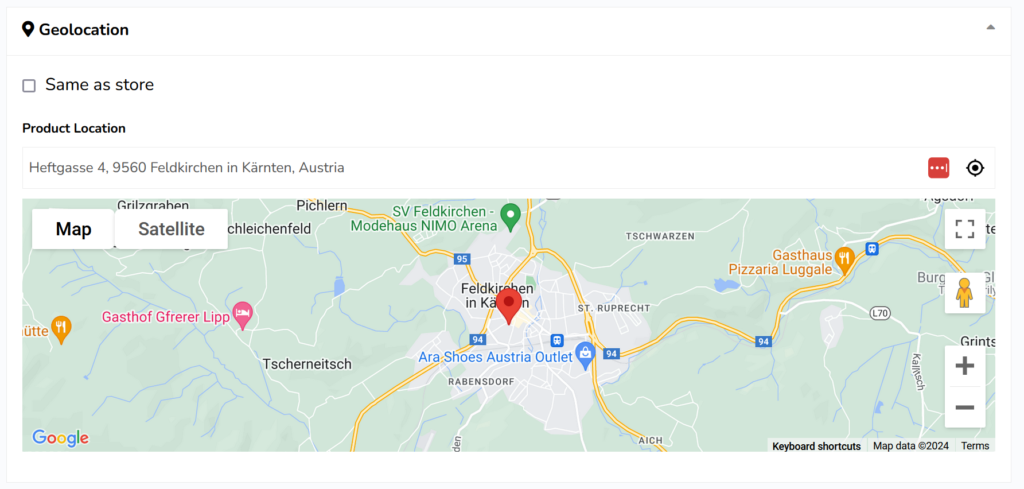

Geolocation

Here you can choose to display your product on a different location on the map, for example if you are hosting a workshop somewhere else.

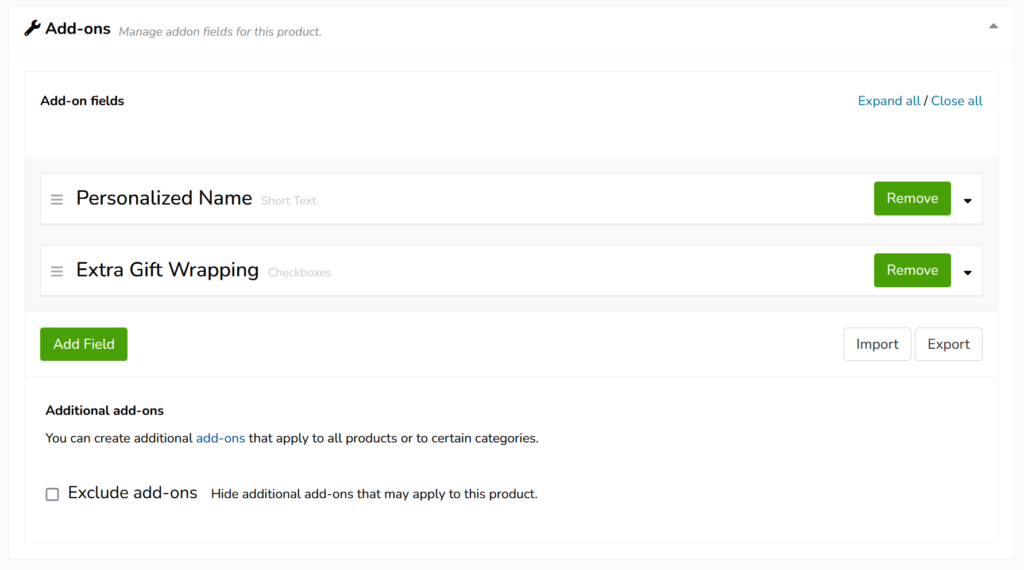

Add-Ons

Add-Ons allow you to let the customer add things to their order. Think McDonalds and “Would you like fries with that?”

e.g.

Short Text – allows the customer to enter a short text, e.g. to be used for customization and adding someones name to your ceramics, or for adding personalized handwritten notes to be included with the order (e.g. like florists do with gifting flowers)

You could add on extra gift-wrapping, or an extra donation to help raise money to plant a tree… the options are endless.

By adding extras to your products, this is a great way to delight your customers and boost your bottom line and make more money.

Shipping and Tax

Please see our Shipping article.

Please see our Tax article here (still to come)

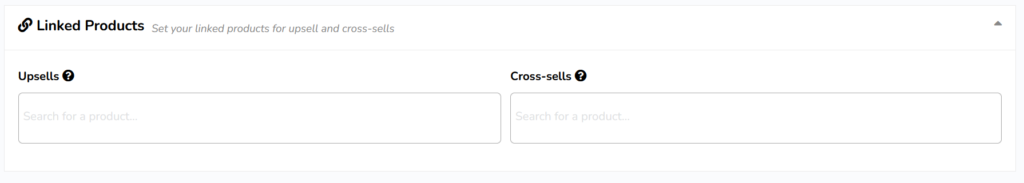

Linked Products

Here you can choose some Up-Sells (things that cost more) or Cross-Sells (Things that roughly cost the same but are complimentary) to the product.

E.g. If you are selling a mug, you may want to add a coffee pot as the up-sell, and a coaster as the cross-sell.

These products will be displayed under this product so the customer will see them right away.

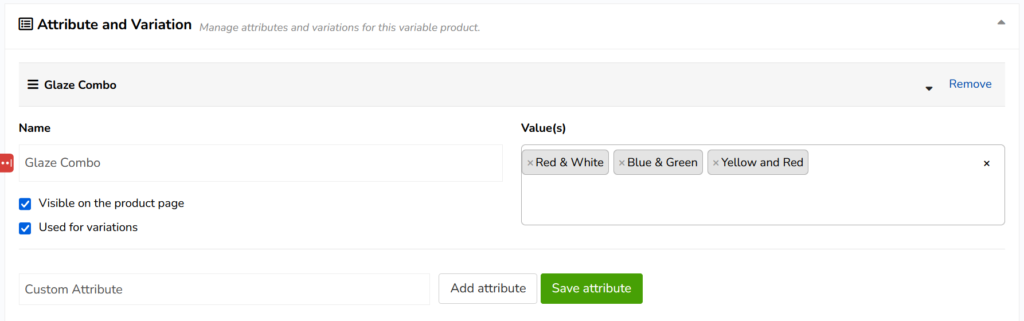

Attributes and Variations

Attributes allow you to add extra detail onto the product page, for example, how the piece is fired, what clay you used, etc.

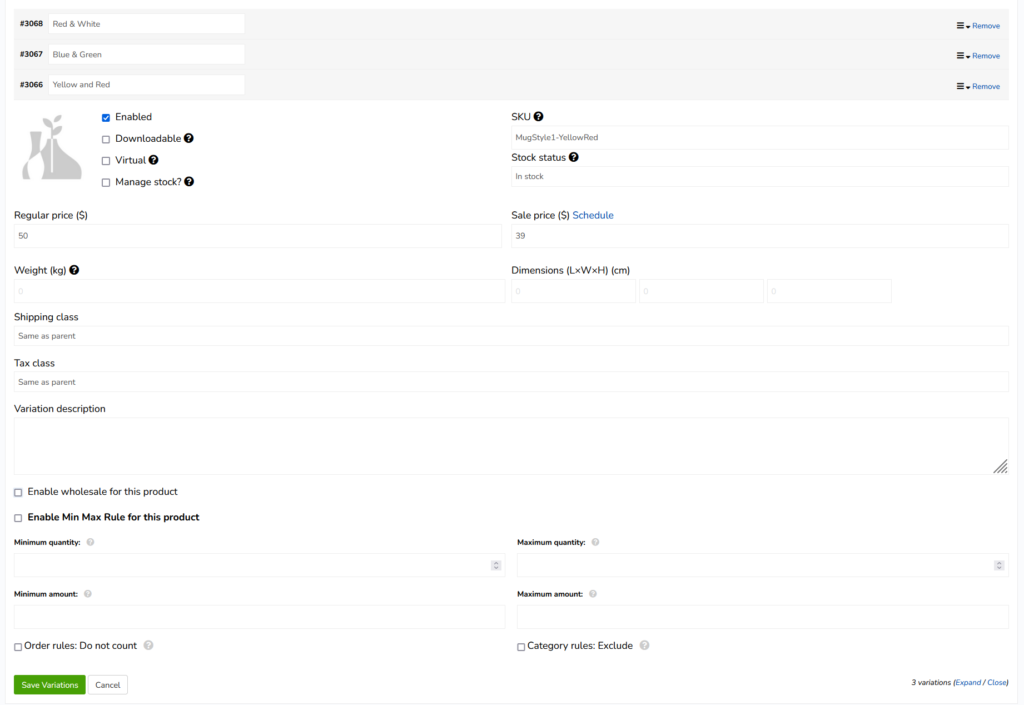

You can also use Attributes for setting up your Variable Products, here we have an example of a Glaze Combo attribute, with three different values: Red & White, Blue & Green, Yellow & Red.

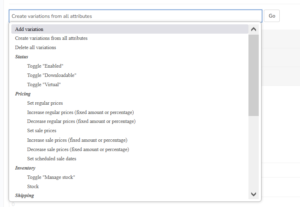

If this is a variable product type, and we tick the “Use for Variations” box, and then save the attributes, then we can add some variations to the product using the variations options drop down box.

Directly under the attributes you can see a Variations options drop down box.

We selected Create variations from all attributes and clicked on the Go button. This made three variations based on our glaze combo attributes.

If you had two attributes, for glaze combo and also size: Small, Medium, Large, then this option would have created several variations for you: Red & White Small, Red & White Medium, Red & White Large, Blue & Green Small… etc.

Here you can see that we have setup the attributes, and then added three variations – and we have the Yellow and Red variation open.

Here we can upload a different image to the variation, and set the price and stock options too.

This allows you to setup one product page, and let the customer choose which variation they want.

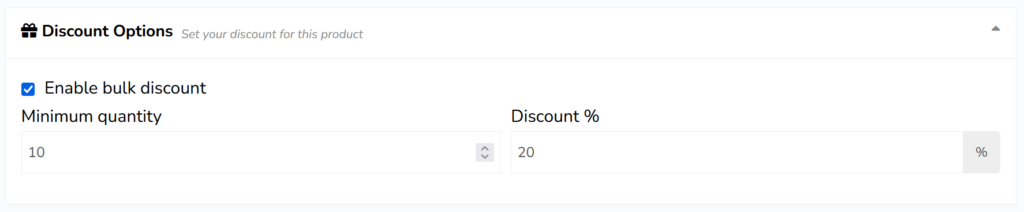

Bulk Discount

This setting allows you to incentivize bulk orders, so for example, here we have set it so that if a customer orders 10 pieces or more, they will get a 20% discount.

This setting allows you to incentivize bulk orders, so for example, here we have set it so that if a customer orders 10 pieces or more, they will get a 20% discount.

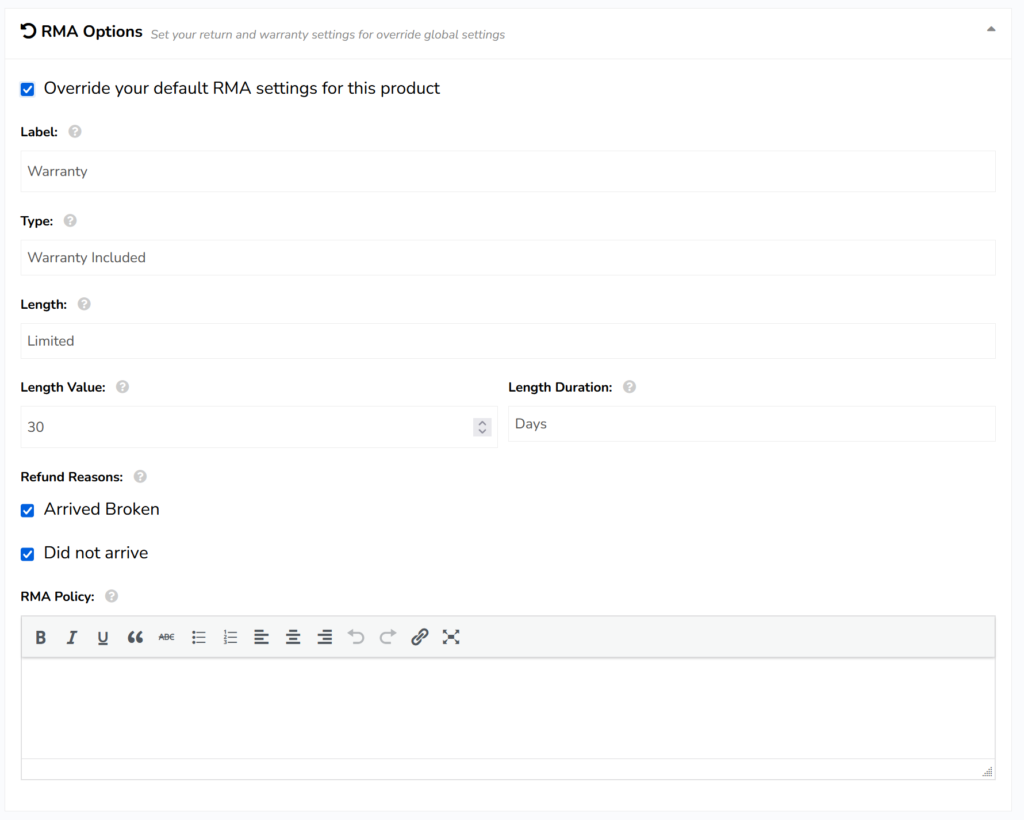

RMA

Here you can choose to override your default “Return Merchandise Authorization” settings for this product. Basically, what are the rules for customers returning a product. For example, if you are selling a one-off large vase, then you may want to change the warranty / return information.

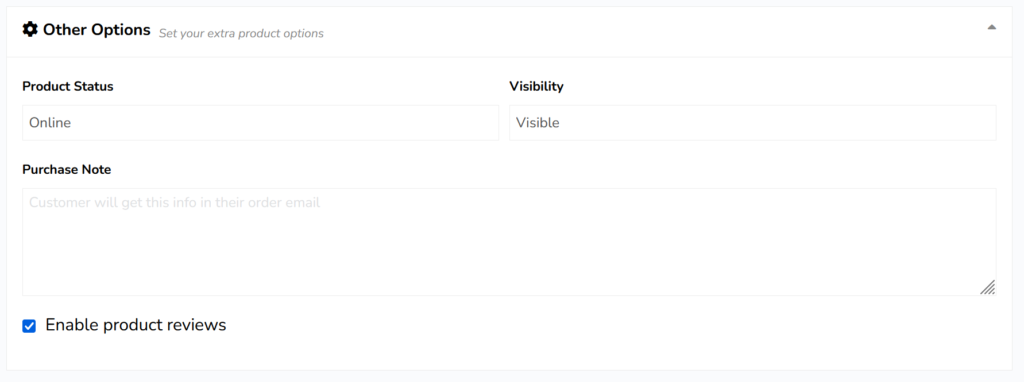

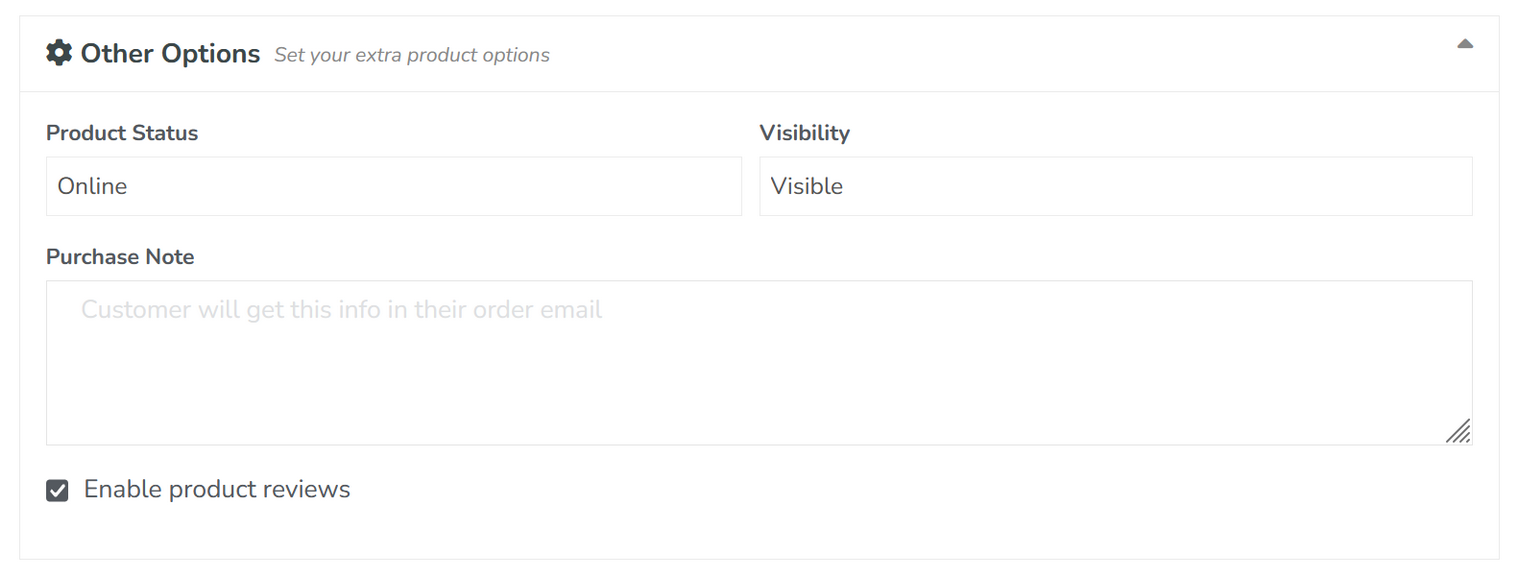

Other Options

Product Status

Here you can choose if your product is online or a draft.

This is good for uploading your products and keeping them as drafts, and then once they are all uploaded, you can set them all to be online for e..g a shop drop.

Visibility

Visible – your products can be seen everywhere.

Catalog – your products can only be seen in the products pages.

Search – your products can only be found when someone uses the search bar, they will not be on your shop page or in the products page.

Hidden – your product is online and people can buy it, but it is completely hidden from the shop page,. the products page, and the search bar- The only way to buy your product is if you know the website address link – This is good for example, if you want to make a special hidden product just for one person, or as a bonus for e.g. signing up for your mailing list.

Purchase Note

The customer will receive this note in their order confirmation email, and also on the checkout complete page. This is where you can give them specific instructions for their order, e.g. how they can any digital downloads, or what happens next with their subscription, or just to say thank you to them for buying your products, etc.

Enable Product Reviews

You can turn on product reviews for certain products.

We recommend keeping them on, and asking for product reviews inside the purchase note, as any reviews will go towards your overall shop rating, and people trust online reviews, which makes selling your products easier.

Adding Auction Products

Check out our help article on Auctions here.

Adding Bookable Products

Check our our help article on Bookable products here (Still to come)

Auctions

Hosting auctions is a great way to sell your ceramics, special event tickets, or various other products, physical or digital.

They are a great way to sell your seconds, or even to help raise money for charity.

Auctions hosted on POTSY look similar to this:

Creating Auctions

The beginning fields are the same as adding a normal product, and quite self-explanatory. So we will skip that part.

Auction Product Settings

Item Condition: Please select either New or Used depending on what you are auctioning.

Auction Type: A Normal Auction is where you are selling something for the highest price.

A Reversed Auction is where you want to buy something for the lowest price and would like to receive offers from different sellers/shops to find the cheapest option. For example, in a reversed auction, say you want to buy a kilo of clay, and then sellers will put in a bid for how much they would charge you to buy a kilo of clay. The winner will be the seller offering a kilo of clay at the lowest price.

Enable Proxy Bidding: Proxy bidding refers basically to the automatic type of bidding. In an auction, when you place a bid and another user outbids you, you need to again come back and bid higher in order to remain the highest bidder. To avoid coming back, you can use automatic bidding which bids on behalf of you when someone outbids you. You can initially enter the maximum amount with which you are comfortable with then our plugin will bid on your behalf of you till that maximum amount is reached.

Enable Sealed Bidding: In this type of auction all bidders simultaneously submit sealed bids so that no bidder knows the bid of any other participant. The highest bidder pays the price they submitted. If two bids with same value are placed for auction the one which was placed first wins the auction.

Start Price: This is the minimum price. So the bidding will start from here. Like you have set $10 as a starting price. So bidding will start from $10 and will increase each time when customers place a bid.

Bid increment: The amount that each customer will be able to increase each time while bidding. Like if you have set a starting price of $10 and increment to $2. So each time the customers increase the bid, it will increase like $12, $14, $16 and so on.

Reserved price: A reserve price is the lowest price at which you are willing to sell your item. If you don’t want to sell your item below a certain price, you can set a reserve price. The amount of your reserve price is not disclosed to your bidders, but they will see that your auction has a reserve price and whether or not the reserve has been met. If a bidder does not meet that price, you are not obligated to sell your item.

Buy it now price: This allows someone to skip the auction and buy your product right away at a set price. The Buy it now option disappears when bid exceeds the Buy now price for normal auction or is lower than a reverse auction.

Auction Start date: You have to put the date you want to start the auction on. This can be the current time or a time that is coming in the future. This allows you to list your auction now, but only allow bids to start at a set date and time.

Auction End date: The time you will stop taking bids. After exceeding this time, people will not be able to bid on that product. Once the auction has reached its end date, the auction will no longer be visible to people. If someone had won the auction, then they will be notified by email.

Enable Automatic Relisting: If your auction does not end up selling because it either did not reach the reserve price, or there were no bids, then you can check this box to automatically relist the auction to start again.

Auction Activity

Now you can check out the activity of each auction product. You will get data on who is bidding, the amount, user email, etc.

Just click on the Auction Activity button from My Shop –> Auctions.

On the next page, you will see all the activities of the auction product. You can filter the activity date-wise and also search for auction products if the list is too big.

Filter Options

You can filter date-wise, time-wise ( Date to and Date from works separately ). Also, you can search using the username and product name as well.

How Tax Applies to Potsy Orders

Potsy is run by The Ceramic School, which is an Austrian company. Potsy is classed as a Marketplace Facilitator:

A Marketplace Facilitator is defined as a marketplace that contracts with third party sellers to promote their sale of physical property, digital goods, and services through the marketplace. As a result, Potsy is deemed to be a marketplace facilitator for third-party sales facilitated through Potsy.

Marketplace Facilitator legislation is a set of laws that shifts the sales tax collection and remittance obligations from a third party seller to the marketplace facilitator. As the marketplace facilitator, Potsy will now be responsible to calculate, collect, and remit tax on sales sold by third party sellers for transactions destined to EU states where Marketplace Facilitator and/or Marketplace collection legislation is enacted.

Based on applicable EU enacted marketplace facilitator tax laws, Potsy automatically calculates, collects, and remits EU sales tax on behalf of sellers located anywhere in the world when:

- An order is sent to a recipient in the EU; or

- A digital order is purchased by a EU buyer; and

- The order meets certain criteria.

Whether Potsy calculates sales tax on orders and the rate that is charged will depend on the specific taxing authority treatment and hence on how the item is listed.

Potsy is a registered sales tax vendor in the countries listed below and will collect sales tax on all taxable sales when required to.

Adding Product Taxes to Potsy

When adding products to Potsy, you can choose which Tax status the product has (Standard, Reduced, or Zero). You will mostly always keep this set to Standard.

When adding products to Potsy, you can choose which Tax status the product has (Standard, Reduced, or Zero). You will mostly always keep this set to Standard.

How to manage sales tax and marketplace sales

There are two scenarios that may come up when managing sales tax and marketplace sales:

- All of a seller’s sales are made on a marketplace.

- A percentage of sales are made on a marketplace.

We’ll walk through how to manage these different scenarios.

Marketplace-only sales

If a seller is only making sales on a marketplace and has confirmed the marketplace is collecting sales tax on its behalf, the seller does not have to calculate, collect, or remit the sales tax from its customers. However, the seller is still required to prepare and file a tax return by the due date that reports how much tax was collected by the marketplace. In this scenario, the seller will likely not owe the state anything, but will fulfill its filing requirements.

Percentage of sales on a marketplace

Let’s say a seller makes 50% of its sales on a marketplace and 50% on its own website. For the marketplace sales, the seller would want to ensure that the marketplace is collecting and remitting tax on its behalf, and maintain records of how much tax is collected on the marketplace. For the 50% of the sales made on its website, the seller is required to collect and remit tax on those sales, assuming it has met economic nexus in the relevant state.

When it comes time to file, the seller must report both how much was collected and remitted by the marketplace, as well as how much the seller directly collected from customers on its website. The seller will only have to pay (remit) the sales tax it has collected, not what the marketplace collected. Most state tax websites in the US will break out marketplace sales from website sales in separate lines, so sellers can easily add in the correct amounts.

European Union VAT rates

The EU sets the broad VAT rules through European VAT Directives, and has set the minimum standard VAT rate at 15%. The 27 member states (plus UK) are otherwise free to set their standard VAT rates. The EU also permits a maximum of two reduced rates, the lowest of which must be 5% or above. Some countries have variations on this, including a third, reduced VAT rate, which they had in place prior to their accession to the EU.

Member states have now agreed that they will be free to set the reduced rates on most goods and services, including e-books; domestic fuel; clothing; and female hygiene products.

Austrian Covid-19 VAT rate cuts

Austria has temporarily cut VAT to help support businesses and consumers during the Coronavirus pandemic crisis.

| Supply | Old rate | New rate | Implementation date | Ended |

|---|---|---|---|---|

| Non-Alcoholic beverages | 20% | 10% | 01 Jul 2020 | 31 Dec 2021 |

| Hospitality, Culture, some print | 10% | 5% | 01 Jul 2020 | 31 Dec 2021 |

Austria VAT rates | ||

| Rate | Type | Which goods or services |

| 20% | Standard | All other taxable goods and services |

| 13% | Reduced | Domestic flights; entrance to sporting events; admissions to cultural events and amusement parks; firewood; some agricultural supplies; wine production (from farm); cut flowers and plants for decorative use |

| 10% | Reduced | Foodstuffs; take-away food; water supplies; pharmaceutical products; domestic transport (excluding flights); international and intra-community road and rail transport; newspapers and periodicals; printed books; e-books; pay and cable TV; TV licence; social services; domestic refuse collection; treatment of waste and waste water; restaurants (ex all beverages); cut flowers and plants for food production; some agricultural supplies; writers and composers |

| 0% | Zero | Intra-community and international transport (excluding road and rail); hotel accommodation |

Belgium VAT rates | ||

| Rate | Type | Which goods or services |

| 21% | Standard | All other taxable goods and services |

| 12% | Reduced | Some foodstuffs; certain agricultural supplies; some social housing; some construction work on new buildings; certain energy products e.g. coal, lignite, coke; some pesticides and fertilizers; certain tyres and inner tubes for agricultural use |

| 6% | Reduced | Some foodstuffs (including takeaway food); soft drinks; water supplies; some pharmaceutical products; some medical equipment for disabled persons; domestic transport of passengers; some books (including e-books); newspapers and periodicals (with certain exceptions); entrance to cultural events and amusement parks; some social housing; certain repair and renovation of private dwellings; some agricultural supplies; hotel accommodation; admission to sporting events; use of sports facilities; intra-community and international road, rail and inland waterways transport; some motor vehicles (cars for the disabled); some social services; certain undertaker and cremation services; minor repairs (including bicycles, shoes and leather goods, clothing and household linen); firewood; cut flowers and plants for decorative use and food production; writers and composers; firewood; restaurants and catering (all beverages excluded) |

| 0% | Zero | Some daily and weekly newspapers; certain recycled materials and by-products; intra-community and international transport (excluding road, rail and inland waterways) |

Get help solving your VAT challenges

Bulgaria has temporarily cut VAT to help support businesses and consumers during the Coronavirus pandemic crisis.

| Supply | Old rate | New rate | Implementation date | End date |

|---|---|---|---|---|

| Hospitality, restaurants, cafes and books | 21% | 10% | 01 Jul 2020 | 31 Dec 2020 |

Bulgaria VAT rates | ||

| Rate | Type | Which goods or services |

| 20% | Standard | All other supplies of goods or services |

| 9% | Reduced | Hotel accommodation |

| 0% | Zero | Intra-community and international transport |

Croatia Covid-19 VAT rate changes

| Supply | Old rate | New rate | Implementation date | End date |

|---|---|---|---|---|

| Basic foodstuffs | 25% | 13% | TBC | TBC |

Croatia VAT rates | ||

| Rate | Type | Which goods or services |

| 25% | Standard | All other taxable goods and services |

| 13% | Reduced | Some foodstuffs; water supplies (excluding bottled water); newspapers (other than daily published newspapers with less than 50% advertising content); periodicals (magazines other than science periodicals with less than 50% advertising content); tickets for concerts; hotel accommodation; café, restaurant and hotel services (excluding alcohol); some agricultural inputs; certain undertaker and cremation services supplies; children’s car seats; electricity supply; some writers and composers services; some domestic waste collection |

| 5% | Reduced | Some foodstuffs (including bread, milk and infant formula); pharmaceutical products (only approved medicines prescribed by a doctor); some medical equipment; books (including e-books); daily newspapers (with less than 50% advertising content); scientific periodicals; admission to cinema |

| 0% | Zero | Intra-community and international transport (excluding road and rail) |

Cyprus Covid-19 VAT rate cuts

Cyprus has temporarily cut VAT to help support businesses and consumers during the Coronavirus pandemic crisis.

| Supply | Old rate | New rate | Implementation date | End date |

|---|---|---|---|---|

| Hotels, accommodation, hospitality, restaurants, cafes and public transport | 9% | 5% | 01 Jul 2020 | 10 Jan 2021 |

Cyprus VAT rates | ||

| Rate | Type | Which goods or services |

| 19% | Standard | All other taxable goods and services; land transactions for business use |

| 9% | Reduced | Domestic road passenger transport; domestic passenger transport by sea; hotel accommodation; restaurants and catering services; cafes |

| 5% | Reduced | Certain foodstuffs; non-alcoholic beverages; water supplies; pharmaceutical products; medical equipment for disabled persons; children’s car seats; certain passenger transport; books (excluding e-books); newspapers and periodicals; admission to cultural events and amusement parks; writers and composers; renovation and repair of private dwellings; some agricultural supplies; admission to sports events; use of sporting facilities; domestic waste collection; hairdressing; some undertaker and cremation services; LPG (in cylinders); take away food (excluding soft drinks and alcoholic beverages); social housing; cut flowers for food production; waste and waste water treatment; works of art, collectors items and antiques; certain services on intracommunity flights |

| 0% | Zero | Intra-community and international transport; goods purchased on international flights |

Czech Republic Covid-19 VAT rate cuts

Czech Republic has temporarily cut VAT to help support businesses and consumers during the Coronavirus pandemic crisis.

| Supply | Old rate | New rate | Implementation date | End date |

|---|---|---|---|---|

| Accommodation; sports and cultural activities | 15% | 10% | 01 Jul 2020 | 31 Dec 2020 |

Czech Republic VAT rates | ||

| Rate | Type | Which goods or services |

| 21% | Standard | All other taxable goods and services |

| 15% | Reduced | Foodstuffs (excluding essential child nutrition and gluten-free food); non-alcoholic beverages; take away food; water supplies; medical equipment for disabled persons; children’s car seats; some domestic passenger transport; admission to cultural events, shows and amusement parks; writers and composers; social housing; renovation and repair of private dwellings; cleaning of private households; some agricultural supplies; hotel accommodation; admission to sporting events; use of sporting facilities; social services; supplies to undertaker and cremation services; medical and dental care; domestic care services; firewood; some pharmaceuticals; some domestic waste collection and street cleaning; treatment of waste and waste water; food provided in restaurants and cafes; cut flowers and plants for decorative use; writers, composers and food production |

| 10% | Reduced | Foodstuffs (selected baby food and gluten-free food); newspapers and periodicals; some pharmaceutical products; some books (including e-books) |

| 0% | Zero | Intra-community and international transport |

Denmark VAT rates | ||

| Rate | Type | Which goods or services |

| 25% | Standard | All other taxable goods and services |

| 0% | Zero | Newspapers and journals (published more than once a month); intra-community and international transport |

Estonia VAT rates | ||

| Rate | Type | Which goods or services |

| 20% | Standard | All other taxable goods and services |

| 9% | Reduced | Certain pharmaceutical products; medical equipment for disabled persons; books (excluding e-books); newspapers and periodicals; hotel accommodation |

| 0% | Zero | Intra-community and international transport |

Finland VAT rates | ||

| Rate | Type | Which goods or services |

| 24% | Standard | All other taxable goods and services |

| 14% | Reduced | Foodstuffs (excluding live animals); some agricultural supplies; restaurants and catering services (excluding alcoholic beverages); soft drinks; take away food; cut flowers and plants for food production |

| 10% | Reduced | Pharmaceutical products; domestic passenger transport; books (including e-books); newspapers and periodicals (sold on subscription); admission to cultural events and amusement parks; TV licence; writers and composers; hotel accommodation; admission to sports events; use of sports facilities; domestic transport |

| 0% | Zero | Printing services for publications of non-profitmaking organisations; intra-community and international transport; some taxation of gold ingots, bars and coins; certain works of art, collectors items and antiques |

France VAT rates | ||

| Rate | Type | Which goods or services |

| 20% | Standard | All other taxable goods and services |

| 10% | Reduced | Some foodstuffs; certain non-alcoholic beverages; some pharmaceutical products; domestic passenger transport; intra-community and international road (some exceptions) and inland waterways transport; admission to some cultural services ;admission to amusement parks (with cultural aspect); pay/cable TV; some renovation and repairs of private dwellings; some cleaning in private households; some agricultural supplies; hotel accommodation; restaurants (excluding alcoholic beverages); some domestic waste collection; certain domestic care services; firewood; take away food; bars, cafes and nightclubs (except supply of alcoholic beverages); cut flowers and plants for decorative use; writers and composers etc; some social housing; some works of art, collectors items and antiques |

| 5.5% | Reduced | Some foodstuffs; some non-alcoholic beverages; school canteens; water supplies, medical equipment for disabled persons; books (excluding those with pornographic or violent content); some e-books; admission to certain cultural events; some social housing; some renovation and repair of private dwellings; admission to sports events; some domestic care services; cut flowers and plants for food production; sanitary protection for women |

| 2.1% | Reduced | Some pharmaceutical products; some newspapers and periodicals; public television licence fees; admission to certain cultural events; some livestock intended for use as foodstuff |

| 0% | Zero | Intra-community and international transport (excluding road and inland waterways) |

Germany VAT rates | ||

| Rate | Type | Which goods or services? |

| 19% | Standard | All other taxable goods and services |

| 7% | Reduced | Some foodstuffs, water supplies (excluding bottled water), medical equipment for disabled persons, certain domestic passenger transport, intra-community and international passenger transport for certain road, rail, and inland waterway transportation, books (excluding books whose content is harmful to minors), e-books, audiobooks, newspapers and periodicals (except those containing content harmful to minors and/or more than 50% advertising), admission to cultural events, writers and composers, some agricultural inputs, short-term hotel accommodation, certain admission to sports events, social services, medical and dental care, firewood, some timber for industrial use, takeaway food, cut flowers and plants for decorative use and food production, taxation of some gold coins and jewelry. |

| 0% | Zero | Intra-community and international transport (excluding road and rail and some inland waterways transport) |

| Supply | Old rate | New rate | Implementation date | End date |

|---|---|---|---|---|

| Transport, coffee, non-alcoholic beverages, cinemas and tourist services | 24% | 13% | 01 Jun 2020 | 30 Apr 2021 |

Greece VAT rates | ||

| Rate | Type | Which goods or services |

| 24% | Standard | All other taxable goods and services |

| 13% | Reduced | Some foodstuffs; certain take away food; some cut flowers and plants for food production; some non-alcoholic beverages; water supplies; some pharmaceutical products; some medical equipment for disabled persons; some agricultural supplies; domestic care services; hotel accommodation (bed and breakfast); certain social services; restaurant and catering (other than entertainment centres); services for boarding schools; structures for disabled persons; structures providing accommodation for mentally disabled persons, people with mental disorders and drug users |

| 6% | Reduced | Some pharmaceutical products; some books (excluding e-books); some newspapers and periodicals; certain theatre and concert admissions; supply of electricity, gas and district heating |

| 0% | Zero | Intra-community and international air and sea transport |

Hungary VAT rates | ||

| Rate | Type | Which goods or services |

| 27% | Standard | All other taxable goods and services |

| 18% | Reduced | Certain foodstuffs; some take away food; admission to certain open-air concerts |

| 5% | Reduced | Certain foodstuffs; pharmaceutical products (intended for human use); some medical equipment for disabled persons (excluding repair); books (excluding e-books); newspapers and periodicals; some social housing; district heating; some supplies of new buildings; restaurant and catering services (food prepared on site and non-alcoholic beverages); internet access services; certain writers and composers services; accommodation services from hotels, B&B and house sharing |

| 0% | Zero | Intra-community and international transport |

Ireland Covid-19 VAT rate changes

Ireland has announced a temporary Value Added Tax rate cut from 23% to 21%. The measure will come into place on 1 September 2020 until 28 February 2021.

| Supply | Old rate | New rate | Implementation date | End date |

|---|---|---|---|---|

| Standard rate | 23% | 21% | 01 Sep 2020 | 28 Feb 2021 |

| Tourism and hospitality services | 13.5% | 9% | 01 Nov 2020 | 31 Dec 2021 |

Ireland VAT rates | ||

| Rate | Type | Which goods or services |

| 23% | Standard | All other taxable goods and services |

| 13.5% | Reduced | Certain foodstuffs; some pharmaceutical products; children’s car seats; social housing; renovation and repair of private dwellings; cleaning in private households; some agricultural supplies; medical and dental care; collection of domestic waste; treatment of waste and waste water; minor repairs of bicycles, shoes and leather goods and household linen; supplies of natural gas, electricity and district heating; heating oil; firewood; construction work on new buildings; supply of immovable property; some social housing; routine cleaning of immovable property; health studio services; tourism services; photography services; services supplied by jockeys; works of art and antiques; short term hire of certain passenger vehicles; driving schools; services supplied by veterinary surgeons; cut flowers and plants for decorative use; concrete and concrete blocks; some books; admission to amusement parks; hotel accommodation; restaurant and catering (excluding beverages); hairdressing; take-away food; bars and cafes |

| 9% | Reduced | Certain foodstuffs; newspapers and periodicals; admission to cultural events; use of sports facilities; hairdressing; e-books and digital publications |

| 4.8% | Reduced | Livestock intended for use in the preparation of foodstuffs; some agricultural supplies |

| 0% | Zero | Some foodstuffs; wax candles (undecorated); certain animal feed; certain fertilizers; some food supplies for food production; some medicines for human consumption; some medicines for veterinary use (excluding pets); certain feminine hygiene products; some medical equipment; clothing and footwear for children; intra-community and international transport; cut flowers and plants for food production; supplies of seeds and plants for use in food production; some books; childrens’ nappies |

Italy VAT rates | ||

| Rate | Type | Which goods or services |

| 22% | Standard | All other taxable goods and services |

| 10% | Reduced | Some foodstuffs; water supplies; some pharmaceutical products; domestic passenger transport; admission to cultural events; some social housing; renovation and repair of private dwellings; some construction work on new buildings; some supplies of new buildings (non-luxurious); some agricultural supplies; hotel accommodation; restaurants; admission to certain sports events; energy products (excluding district heating); firewood; collection of domestic waste; some waste water treatment; alcoholic beverages in bars and cafes; take away food; cut flowers and plants for decorative use and food production |

| 5% | Reduced | Some foodstuffs; some social services; certain passenger transport |

| 4% | Reduced | Some food products; certain medical equipment for disabled persons; certain books; newspapers and some periodicals; e-books with an international standard book number (ISBN) ; online journals newspapers; TV licence; some social housing; some agricultural supplies; certain social services; motor vehicles for the disabled; construction work on new buildings (for first housing); supplies of new buildings (for first housing) |

| 0% | Zero | Intra-community and international transport |

Latvia VAT rates | ||

| Rate | Type | Which goods or services |

| 21% | Standard | All other taxable goods and services |

| 12% | Reduced | Food products for infants; pharmaceutical products; medical products for disabled persons; domestic passenger transport; books (excluding e-books); newspaper and periodicals; hotel accommodation; district heating |

| 5% | Reduced | A range of locally produced vegetables and fruit |

| 0% | Zero | Intra-community and international transport |

Lithuania VAT rates | ||

| Rate | Type | Which goods or services |

| 21% | Standard | All other taxable goods and services |

| 9% | Reduced | Some domestic passenger transport; hotel accommodation; district heating; books (excluding e-books); firewood |

| 5% | Reduced | Pharmaceutical products; medical equipment for disabled persons; newspapers and periodicals (some exceptions) |

| 0% | Zero | Intra-community and international transport |

Luxembourg VAT rates | ||

| Rate | Type | Which goods or services |

| 16% | Standard | All other taxable goods and services |

| 14% | Reduced | Certain wines; solid mineral fuels, mineral oils and wood intended for use as fuel with the exception of wood for heating; washing and cleaning products; printed advertising matter; heat, cooling and steam with the exception of district heating; safe custody and administration of securities; administration of credit and credit guarantees by a person or organisation other than that granting the credit |

| 8% | Reduced | Cleaning in private households; minor repairs of bicycles, shoes and leather goods, clothing and household linen; hairdressing; district heating; natural gas; electricity; firewood; LPG; cut flowers and plants for decorative use; some works of art and antiques |

| 3% | Reduced | Foodstuffs; soft drinks; children’s clothing and footwear; water supplies; certain pharmaceutical products; certain medical equipment for disabled persons; domestic passenger transport; certain books (including e-books); certain newspapers and periodicals; admission to cultural events and amusement parks; some pay TV/cable TV; agricultural supplies (excluding pesticides); hotel accommodation; restaurants (excluding alcoholic beverages); take away food; bars, cafes and nightclubs, cut flowers and plants for food production; some supplies of new buildings; some construction work on new buildings; admission to sports events; use of sports facilities; undertaker and cremation services; collection of domestic waste; some telephone services; some writers and composers services (royalties); raw wool; treatment of waste and waste water; some goods and services for consumption on-board passenger transport; some works of art, collectors items and antiques |

| 0% | Zero | Intra-community and international transport |

Malta VAT rates | ||

| Rate | Type | Which goods or services |

| 18% | Standard | All other taxable goods and services |

| 7% | Reduced | Hotel accommodation; use of sporting facilities |

| 5% | Reduced | Medical equipment for disabled persons; books (including e-books); newspapers and periodicals; admission to some cultural events; minor repairs of shoes and leather goods, bicycles, clothing, and household linens; domestic care services; supply of electricity |

| 0% | Zero | Some supplies of food for human consumption (excluding some processed and pre-cooked foods); prescribed medicines; gold ingots and bars; live animals for human consumption; intra-community and international transport; domestic passenger transport (excluding road); cut flowers and plants for food production |

Netherlands VAT rates | ||

| Rate | Type | Which goods or services |

| 21% | Standard | All other taxable goods and services |

| 9% | Reduced | Foodstuffs (excluding foodstuffs for animal consumption); some soft drinks; water supplies; certain pharmaceutical products; certain medical equipment for disabled persons; domestic passenger transport (excluding air travel); intra-community and international road, rail and inland waterway passenger transport; books (including e-books); newspapers and periodicals; admission to cultural events and amusement parks; writers and composers; certain renovation and repair of private dwellings; certain cleaning of private households; hotel accommodation; restaurants (excluding alcoholic beverages); take away food; bars, cafes and night clubs; admission to sports events; use of sports facilities; minor repairs of bicycles; shoes and leather goods; clothing and household linen; hairdressing; cut flowers and plants for decorative use (some exclusions) and food production; some works of art, collectors items and antiques |

| 0% | Zero | Taxation of gold coins; intra-community and international passenger transport by air and sea |

Poland VAT rates | ||

| Rate | Type | Which goods or services |

| 23% | Standard | All other taxable goods and services |

| 8% | Reduced | Mustard, sweet pepper (spice) and some processed spices (e.g. pepper, thyme); some unprocessed spices (e.g. cumin, saffron, turmeric); specialised magazines |

| 5% | Reduced | Tropical and citrus fruit, some edible nuts, citrus fruit or melon peels — will be covered by 5% at stake like all fruits; soups, broths, homogenised and dietetic food; food for babies and small children, as well as teats, nappies and car seats; hygienic articles (sanitary napkins, hygienic tampons, diapers); books, brochures, leaflets and similar materials, printed, even in single sheets; regional or local magazines only, for the rest of ex 4902 group 8% applies; children’s, picture, drawing or colouring books; maps and hydrographic maps or similar maps of all kinds, including atlases, wall maps, topographic plans and globes, printed; other printed articles, including printed pictures and photographs – only regional or local magazines (any electronic version of the goods mentioned above) |

| 0% | Zero | Intra-community and international passenger transport (excluding inland waterway and road transport); services supplied during international transport |

Portugal VAT rates | ||

| Rate | Type | Which goods or services |

| 23% | Standard | All other taxable goods and services |

| 13% | Reduced | Some foodstuffs; admission to certain cultural events; restaurant & cafe food; some agricultural supplies; wine; mineral water; diesel for agriculture; some goods and services for consumption on-board transportation |

| 6% | Reduced | Some foodstuffs; water supplies; certain pharmaceutical products; medical equipment for disabled persons; children’s car seats; children’s diapers; domestic passenger transport; some books (including e-books); certain newspapers and periodicals; TV licence; social housing; renovation and repair of private dwellings; certain agricultural supplies; hotel accommodation; some social services; some medical and dental care; collection of domestic waste, minor repairs of bicycles; domestic care services; fruit juices; firewood; cut flowers and plants for decorative use and food production; construction work on new buildings; some legal services; some goods for consumption on-board transportation; treatment of waste water; some works of art, collectors items and antiques |

| 0% | Zero | Intra-community and international passenger transport |

Romania VAT rates | ||

| Rate | Type | Which goods or services |

| 19% | Standard | All other taxable goods and services |

| 9% | Reduced | Foodstuffs; pharmaceutical products; medical equipment for disabled persons; hotel accommodation; water supplies; some beer; soft drinks; cut flowers and plants for food production; some agricultural supplies; some goods and services for consumption on-board transportation. |

| 5% | Reduced | Social housing; books (excluding e-books); newspapers and periodicals; admission to cultural events; admission to sporting events; admission to amusement parks; hotel accommodation; restaurants and catering services (excluding some alcoholic beverages); take-away food; bars, cafes and nightclubs (excluding some alcoholic beverages); Residential properties |

| 0% | Zero | Intra-community and international passenger transport |

Slovakia VAT rates | ||

| Rate | Type | Which goods or services |

| 20% | Standard | All other taxable goods and services |

| 10% | Reduced | Some foodstuffs; some pharmaceutical products; some medical equipment for disabled persons; books (excluding e-books); hotel and accommodation |

| 0% | Zero | Intra-community and international passenger transport |

Slovenia VAT rates | ||

| Rate | Type | Which goods or services |

| 22% | Standard | All other taxable goods and services |

| 9.5% | Reduced | Foodstuffs; water supplies; pharmaceutical products; medical equipment for disabled persons; domestic passenger transport; newspapers and periodicals; cultural events and theme parks; writers and composers; social housing; renovation and repairs of private dwellings; cleaning of private dwellings; agricultural supplies; restaurants (preparation of meals only); hotel accommodation; admission to sports events; use of sports facilities; undertaker and cremation services; domestic waste collection; treatment of waste and waste water; minor repairs of bicycles, clothes and household linen, shoes and leather goods; domestic care services; hairdressing; soft drinks; intra-community and international road passenger transport; some take away food; cut flowers and plants for decorative use and food production; certain supplies of new buildings; certain construction work for new buildings |

| 5% | Reduced | E-books; printed books |

| 0% | Zero | Intra-community and international transport (excluding road transport) |

Spain VAT rates | ||

| Rate | Type | Which goods or services |

| 21% | Standard | All other taxable goods and services |

| 10% | Reduced | Some foodstuffs; water supplies; certain pharmaceutical products; some medical equipment for disabled persons; domestic passenger transport; intra-community and international transport by road, rail and inland waterways; some social housing; some renovation and repair of private dwellings; agricultural supplies; hotel accommodation; restaurants and catering services; some social services; domestic waste collection; some soft drinks; bars, cafes, night clubs and alcoholic beverages sold therein; take away food; cut flowers and plants for food production; some supplies of new buildings; some construction work on new buildings; admission to sporting events (amateur sporting events only); treatment of waste and waste water; admission to certain cultural services |

| 4% | Reduced | Some foodstuffs; some pharmaceutical products; some medical equipment for the disabled; some books (excluding e-books); certain newspapers and periodicals; some social housing; some social services; some construction work on new buildings; some domestic care services |

| 0% | Zero | Taxation of some gold coins, ingots and bars; intra-community and international transport by air and sea |

Sweden VAT rates | ||

| Rate | Type | Which goods or services |

| 25% | Standard | All other taxable goods and services |

| 12% | Reduced | Some foodstuffs; non-alcoholic beverages; take away food; minor repair of bicycles, shoes and leather goods, clothing and household linen; hotel accommodation; restaurant and catering services; some works of art, collectors items and antiques |

| 6% | Reduced | Domestic passenger transport; books (including e-books); newspapers and some periodicals; admission to cultural events (excluding cinema); writers and composers; admission to sports events; use of sports facilities |

| 0% | Zero | Medicines supplied on prescription or sold to hospitals; printing and other services related to the production of magazines for non-profit making organisations; intra-community and international passenger transport |

United Kingdom Covid-19 VAT rate changes

United Kingdom has brought forward tax cuts and considers temporary UK VAT rate cut to help support businesses and consumers during the Coronavirus pandemic crisis.

| Supply | Old rate | New rate | Implementation date | End date |

|---|---|---|---|---|

| E-books and online journals | 20% | 0% | 01 May 2020 | – |

| Hospitality and tourism including restaurants; cafes; pubs (ex alcohol); hospitality; hotels; B&B’s; home rental; caravan and tent sites; hot take away food; theatres; circuses; amusement parks; concerts; museums; zoos; cinemas; and exhibitions. Note: served alcoholic drinks will not benefit from the cut. | 20% | 5% | 15 Jul 2020 | 31 Mar 2021 |

United Kingdom VAT rates | ||

| Rate | Type | Which goods or services |

| 20% | Standard | All other taxable goods and services |

| 5% | Reduced | Children’s car seats; certain social housing; some social services; electricity, natural gas and district heating supplies (for domestic use only); some energy-saving domestic installations and goods; LPG and heating oil (for domestic use only); some renovation and repairs of private dwellings; some medical equipment for disabled persons |